Things Are Getting Frothy - Here Are Six More Reasons Not to Sell Your Gold

Fetch error

Hmmm there seems to be a problem fetching this series right now.

Last successful fetch was on April 28, 2025 02:14 (

What now? This series will be checked again in the next hour. If you believe it should be working, please verify the publisher's feed link below is valid and includes actual episode links. You can contact support to request the feed be immediately fetched.

Manage episode 478616910 series 3586928

Gold again today. I just can’t stop writing about it.

Another day. Another new high. We touched $3,500 in the early hours of yesterday morning.

That’s 27 new highs in the gold price so far this year.

Yet there is still something about this bull market that doesn’t feel right or complete: it’s not confirmed by silver, which should be trading north of $50. Instead it’s mired around $32. Nor is this bull market confirmed by the miners, which, in most cases, are nowhere near all-time highs.

Nevertheless, on the basis of gold’s price relative to equities, commodities and houses, as outlined last week, gold is starting to look expensive. Is it time to have an eye on the exit?

In the short term, maybe. It’s overbought. We are going into a weak time of year for gold (May to August). But that’s why I like physical. It stops you trading!

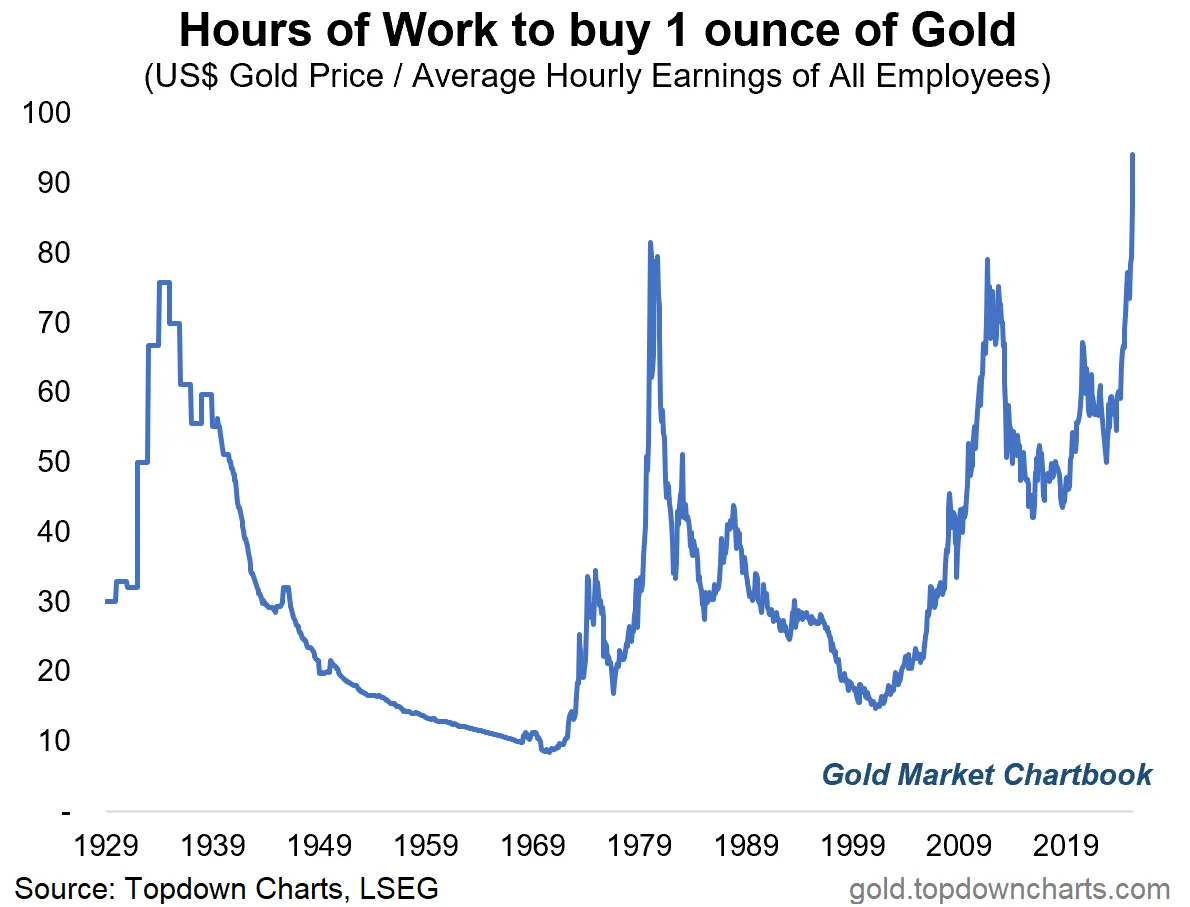

How about this for a chart?

It now takes more work than at any time in the last 100 years to buy an ounce of gold.

This is as much a function of declining wages in real terms, and the erosion in value of fiat, as it is the price of gold, but all the same it’s pretty incredible: how we’ve all been lied to!

There are, though, many signs that gold is now fully valued.

But these are not normal times.

And a “proper” bull market will see blow-off tops in silver and the miners. We don’t have that yet.

Let me give you six more reasons (ie largely previously unmentioned reasons) not to be selling your gold.

1. You live in the UK.

(This is one I have mentioned before). Do not be fooled by the fact that the pound has been performing relatively well in the foreign exchange markets this year. It has lost 37% of its purchasing power since 2020 and has repeatedly proven to be a rotten store of value.

The interest on UK gilts is rising, meaning it is getting increasingly expensive for the government to pay for its own debt. We’re above Liz Truss levels and the trend is rising.1

We’ve got high energy costs too.

What this government is actually doing to rein in its spending is one thing. What needs to be done is something else. There is no Elon Musk taking the guillotine to it all. The scale of our government inefficiency, waste, corruption, misallocation of capital is both larger, relative to GDP, and more entrenched than in the US. At the level of government we are not even having a conversation about what needs to be done, let alone actually doing anything.

Nor is there any likelihood of this country re-industriali sing. We’ll just have to hope people buy our services, what few we offer. In the meantime we’ll keep borrowing to pay for stuff.

The only way is currency debasement. There has never been a Labour government that did not devalue sterling. Think this one will be any different? Do not store your wealth in sterling. They take enough from you in taxes as it is. Don’t let them take any more.

As always, if you are looking to buy gold, the bullion dealer I use and recommend is the Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. Find out more here.

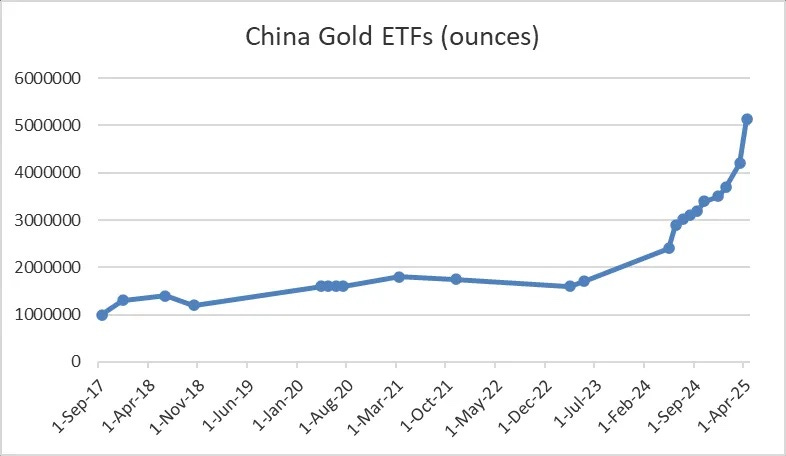

2. Chinese retail

I’m endlessly wittering on about China’s central bank buying gold, but one thing I confess I’ve overlooked is Chinese retail buying. Its real estate and stock markets have both been rubbish, the former especially, so they are buying gold instead.

Then think about the sheer size of China’s retail market: over a billion potential buyers. Never mind central bank buying, the potential scale of this thing is enormous. What if they al buy an ounce each?

When do they stop buying and start selling? When their real estate and stock markets pick up …

Meanwhile, China’s central bank, the PBOC, which says it bought 5 tonnes last month, actually bought ten times that.

(De-dollarisation, which is perhaps the biggest factor of the lot, except re-monetisation, does not even make it onto this list as I‘ve covered it so many times before).

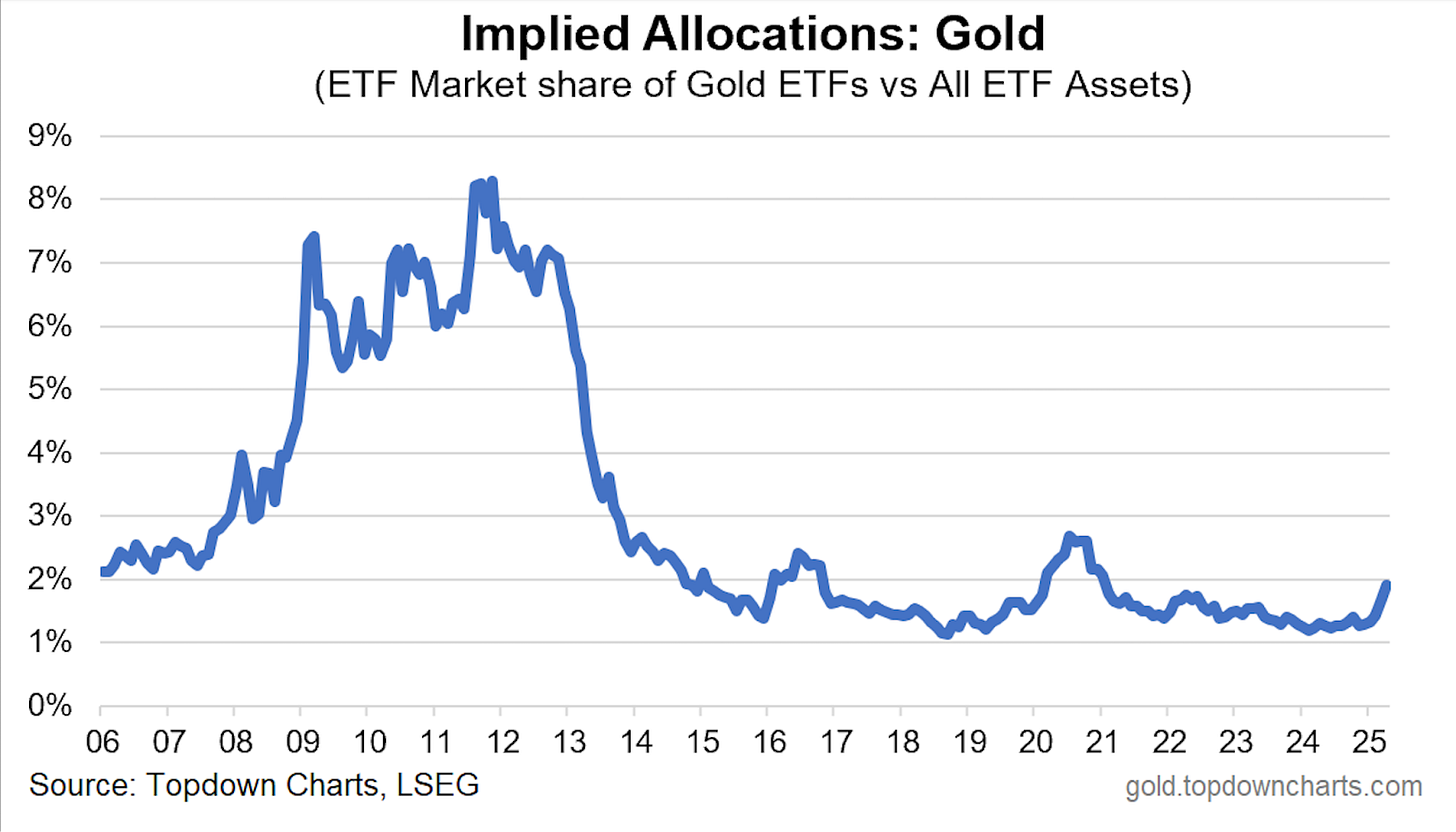

3. What about Western retail? What about Western institutions?

Western retail and institutional investors have been slow to this bull market and are under-allocated. As my buddy Ross Norman says, “this gold rally has not, to date, been driven by retail investors buying coins and bars, high net clients clamouring for physical, nor institutions buying the gold ETF, not even speculative flows to any great extent. This has been an incredibly low participation rally. A stealth run even”.

Portfolios are roughly 2% allocated to gold at present. They were four times that at the peak of the last bull market in 2011.

That means a lot of room for more Western buying.

Since the confiscation of Russian assets, central banks have bought every pullback to the 50-day moving average. But it’s not just central banks now, retail and institutional investors the world over are coming to the party.

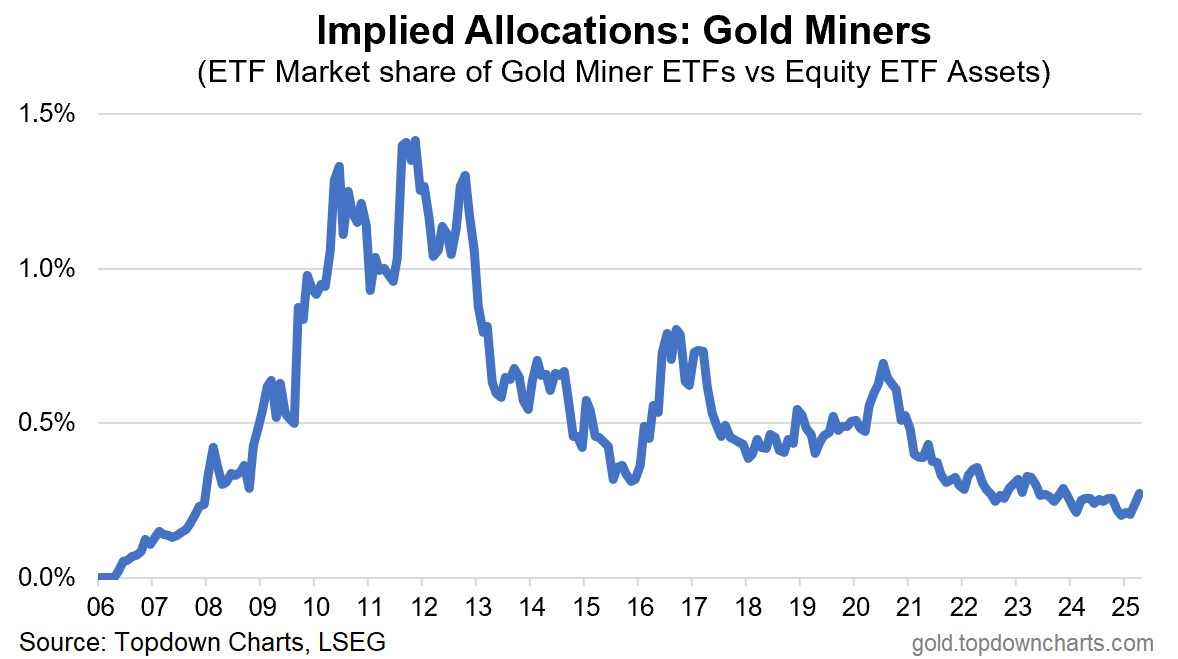

And if you think they’re underweight gold, wait until you see how underweight they are gold miners. (Even these are slowly starting to move - MTL anyone :)?)

4. Gold vs the Nasdaq - OMG

Trends in this ratio tend to go on for a long time, like ten years or more.

How about this for a chart?

19 episodes