Show notes are at https://stevelitchfield.com/sshow/chat.html

…

continue reading

Content provided by LessWrong. All podcast content including episodes, graphics, and podcast descriptions are uploaded and provided directly by LessWrong or their podcast platform partner. If you believe someone is using your copyrighted work without your permission, you can follow the process outlined here https://player.fm/legal.

Player FM - Podcast App

Go offline with the Player FM app!

Go offline with the Player FM app!

“Many prediction markets would be better off as batched auctions” by William Howard

Manage episode 498318478 series 3364760

Content provided by LessWrong. All podcast content including episodes, graphics, and podcast descriptions are uploaded and provided directly by LessWrong or their podcast platform partner. If you believe someone is using your copyrighted work without your permission, you can follow the process outlined here https://podcastplayer.com/legal.

All prediction market platforms trade continuously, which is the same mechanism the stock market uses. Buy and sell limit orders can be posted at any time, and as soon as they match against each other a trade will be executed. This is called a Central limit order book (CLOB).

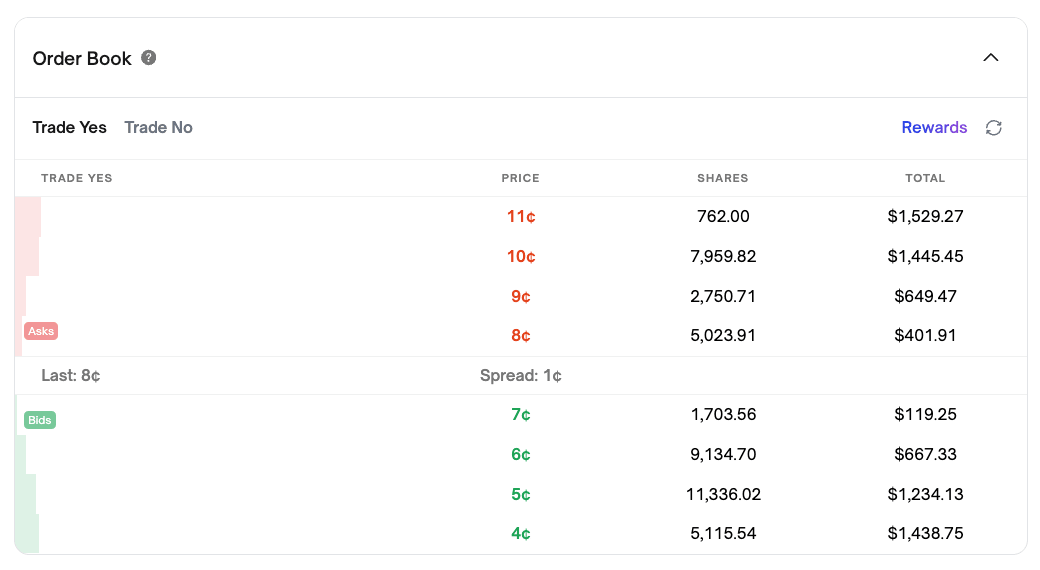

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

…

continue reading

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

592 episodes

Manage episode 498318478 series 3364760

Content provided by LessWrong. All podcast content including episodes, graphics, and podcast descriptions are uploaded and provided directly by LessWrong or their podcast platform partner. If you believe someone is using your copyrighted work without your permission, you can follow the process outlined here https://podcastplayer.com/legal.

All prediction market platforms trade continuously, which is the same mechanism the stock market uses. Buy and sell limit orders can be posted at any time, and as soon as they match against each other a trade will be executed. This is called a Central limit order book (CLOB).

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

…

continue reading

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

592 episodes

All episodes

×Welcome to Player FM!

Player FM is scanning the web for high-quality podcasts for you to enjoy right now. It's the best podcast app and works on Android, iPhone, and the web. Signup to sync subscriptions across devices.