Go offline with the Player FM app!

Money Talk Podcast, Friday Oct. 31, 2025

Manage episode 517044548 series 1036924

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 27-31, 2025)

Significant Economic Indicators & Reports

Monday

An indicator of demand for manufactured products, the Commerce Department’s report on durable goods orders, was unavailable because of the federal government shutdown.

Tuesday

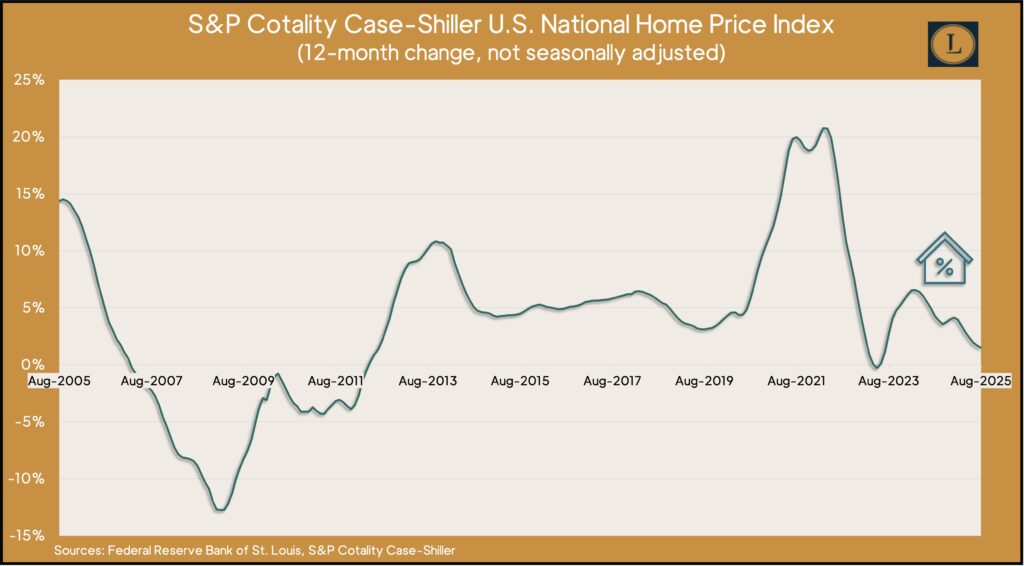

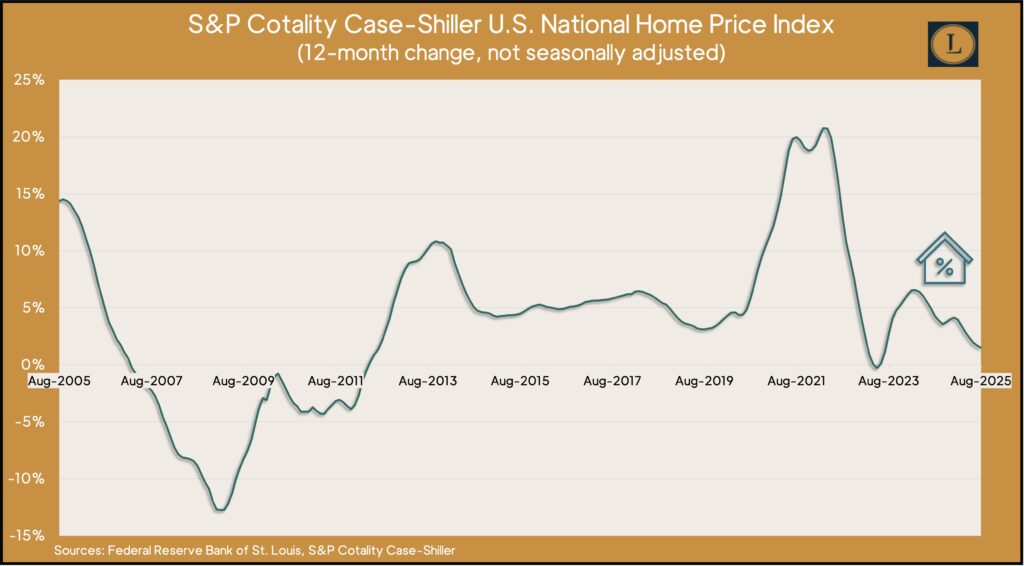

Housing prices continued slowing in August, according to the S&P Cotality Case-Shiller national home price index. The measure showed a 1.5% year-to-year gain in residential prices, the lowest in more than two years and below the overall inflation rate for the fourth straight month. An S&P analyst said the housing market has been trying to find a sustainable equilibrium following its post-pandemic boom. He added, “(H)omeowners are watching their real equity erode while buyers face the dual challenge of elevated prices and high borrowing costs.”

The Conference Board said its consumer confidence index moved sideways in October. The index dipped slightly from September with lower expectations offsetting consumers’ marginally higher opinion of the present situation. The business research group said pessimism about the future continued to suggest an impending recession for the ninth month in a row. Prices and inflation remained the top concerns among survey respondents. Mentions of tariffs declined from earlier surveys but stayed elevated. Some consumers expressed dismay about the federal government shutdown.

Wednesday

The National Association of Realtors said its pending home sales index was unchanged in September and down 0.9% from the year before. The trade association said lower mortgage rates and increased wealth effect – from record-high stock prices and elevated home values – could not overcome apparent softening in the job market. The pending sales index remained more than 25% below its 2001 base, which the Realtors consider a normal level of sales activity.

As expected, the Federal Open Market Committee lowered short-term lending rates by one quarter of a percentage point for the second time in six weeks. The Federal Reserve Board’s policy-making body said continued consideration of slowing labor markets prompted it to loosen monetary control, though it also expressed reluctance to lower rates while inflation stayed above the long-term target of 2%. The September Consumer Price Index showed broad inflation rising at a 3% annual rate, although more complete data reports have been curtailed by the federal government shutdown.

Thursday

The broadest measure of U.S. economic output, the quarterly report on gross domestic product, was not available from the Bureau of Economic Analysis because of the federal government shutdown. The GDP report includes the Fed’s preferred measure of inflation, the personal consumption expenditure index.

The Labor Department’s report on initial unemployment insurance claims was not available for the fifth week in a row because of the federal government shutdown.

Friday

The Bureau of Economic Analysis did not release its consumer spending report for September because of the federal government shutdown.

Market Closings for the Week

- Nasdaq – 23725, up 520 points or 2.2%

- Standard & Poor’s 500 – 6840, up 49 points or 0.7%

- Dow Jones Industrial – 47563, up 356 points or 0.8%

- 10-year U.S. Treasury Note – 4.10%, down 0.10 point

189 episodes

Manage episode 517044548 series 1036924

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 27-31, 2025)

Significant Economic Indicators & Reports

Monday

An indicator of demand for manufactured products, the Commerce Department’s report on durable goods orders, was unavailable because of the federal government shutdown.

Tuesday

Housing prices continued slowing in August, according to the S&P Cotality Case-Shiller national home price index. The measure showed a 1.5% year-to-year gain in residential prices, the lowest in more than two years and below the overall inflation rate for the fourth straight month. An S&P analyst said the housing market has been trying to find a sustainable equilibrium following its post-pandemic boom. He added, “(H)omeowners are watching their real equity erode while buyers face the dual challenge of elevated prices and high borrowing costs.”

The Conference Board said its consumer confidence index moved sideways in October. The index dipped slightly from September with lower expectations offsetting consumers’ marginally higher opinion of the present situation. The business research group said pessimism about the future continued to suggest an impending recession for the ninth month in a row. Prices and inflation remained the top concerns among survey respondents. Mentions of tariffs declined from earlier surveys but stayed elevated. Some consumers expressed dismay about the federal government shutdown.

Wednesday

The National Association of Realtors said its pending home sales index was unchanged in September and down 0.9% from the year before. The trade association said lower mortgage rates and increased wealth effect – from record-high stock prices and elevated home values – could not overcome apparent softening in the job market. The pending sales index remained more than 25% below its 2001 base, which the Realtors consider a normal level of sales activity.

As expected, the Federal Open Market Committee lowered short-term lending rates by one quarter of a percentage point for the second time in six weeks. The Federal Reserve Board’s policy-making body said continued consideration of slowing labor markets prompted it to loosen monetary control, though it also expressed reluctance to lower rates while inflation stayed above the long-term target of 2%. The September Consumer Price Index showed broad inflation rising at a 3% annual rate, although more complete data reports have been curtailed by the federal government shutdown.

Thursday

The broadest measure of U.S. economic output, the quarterly report on gross domestic product, was not available from the Bureau of Economic Analysis because of the federal government shutdown. The GDP report includes the Fed’s preferred measure of inflation, the personal consumption expenditure index.

The Labor Department’s report on initial unemployment insurance claims was not available for the fifth week in a row because of the federal government shutdown.

Friday

The Bureau of Economic Analysis did not release its consumer spending report for September because of the federal government shutdown.

Market Closings for the Week

- Nasdaq – 23725, up 520 points or 2.2%

- Standard & Poor’s 500 – 6840, up 49 points or 0.7%

- Dow Jones Industrial – 47563, up 356 points or 0.8%

- 10-year U.S. Treasury Note – 4.10%, down 0.10 point

189 episodes

All episodes

×Welcome to Player FM!

Player FM is scanning the web for high-quality podcasts for you to enjoy right now. It's the best podcast app and works on Android, iPhone, and the web. Signup to sync subscriptions across devices.